Monetary Policy and the Phillips Curve

Monetary Policy Institute, 2022

"From the perspective of mainstream theory, the effectiveness of monetary policy in bringing down inflation depends on two very important equations: the aggregate demand equation and the infamous Phillips Curve. Without these, it becomes more difficult — or rather impossible — for central banks to carry out monetary policy and obtain the results they expect. Let me break it down."

Comment from our editors:

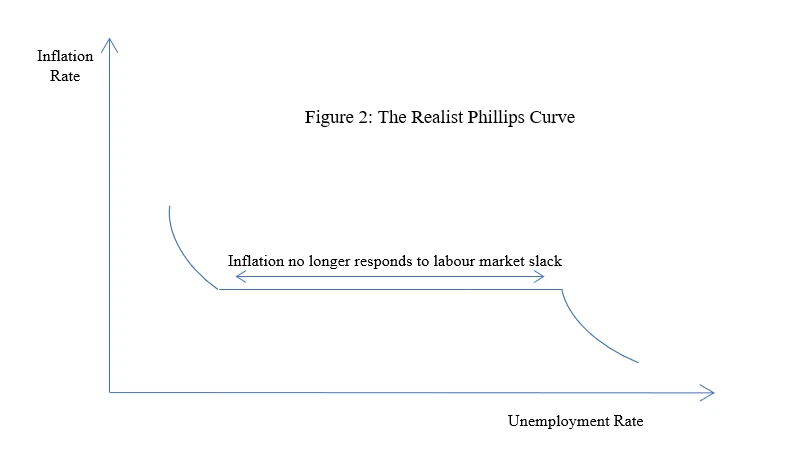

In this short blog note, Louis-Philippe Rochon adresses three "strikes" targeted towards the mainstream theory of monetary policy. Strike one: The effect of changes in the interest rates is less important than what is predicted by mainstream models, as consumption and investments are not sensitive enough. Strike two: A realist Philips Curve is much flatter than the models, since inflation can happen at several levels of unemployment (wage-pressure curve). Strike three: Inflation is also influenced by supply shocks (cost-push inflation), making the changes of the interest rate more futile.

From a Post-Keynesian perspective anyway, the Phillips Curve is supposed to be a theoretical figment: A stable relationship between unemployment and inflation would call for a general equilibrium including full employment to exist; otherwise, there's no reason why inflation ought to rise when employment rises beyond some supposed full employment level. If, however, there is no such thing as a general equilibrium, the Phillips Curve is at best a stylised fact for a very special macroeconomic set of circumstances.

Go to: Monetary Policy and the Phillips Curve