Ecological Economics: A Solution to Deforestation?

Pluralist Economics Fellowship, 2018

This essay is part of the Pluralist Economics Fellowship, jointly put together by the Minerva Schools at KGI & The Network for Pluralist Economics. For more information on this and a collection of the other student essays check out this page.

Ecological Economics: A Solution to Deforestation?

Author: Maike Pfeiffer

Review: Prof. Dollie Davis

- Introduction

Deforestation is estimated to be responsible for about 12-29% of global greenhouse gas emissions (Fearnside 2000, 155-158). Though solutions are negotiated on a transnational basis, such as through the United Nations Convention on Climate Change, logging a forest is often more financially profitable than conserving it (Environmental Defense Fund 2018). Commonly, the economics behind forest conservation relies on a mainstream economic framework while conservation efforts are lagging behind. This essay will explore ecological economics as an alternative lens through which to approach forest conservation and the acceleration of climate change.

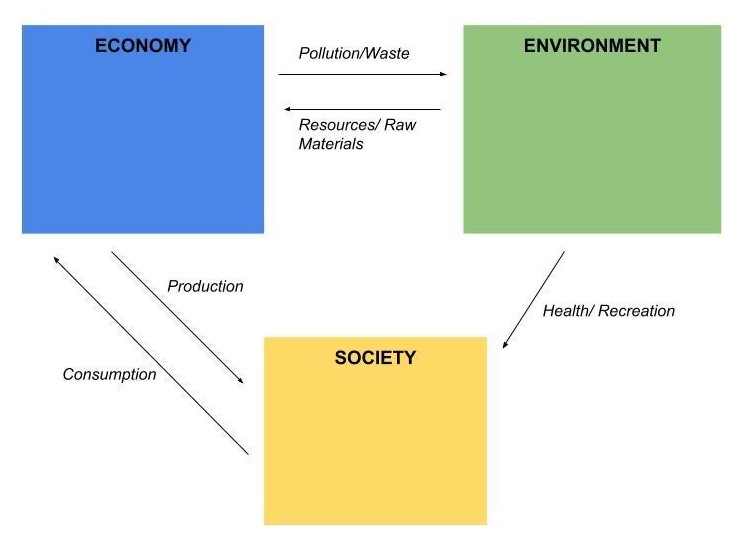

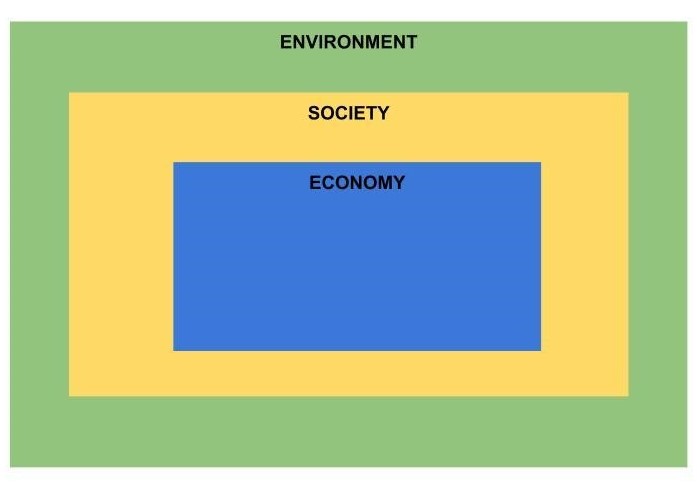

Ecological economics differs from mainstream economics in the role that the environment plays in the system. In mainstream economics, the environment is one part of the economy (Figure 1) to be considered. Thus, the environment becomes a factor, or a sub-sector, of the economy. Ecological economics, on the contrary, considers the environment to be an all-encompassing framework (SOAS 2018). The environment does not exist within the economy, it is the economy that exists within the natural environment (Figure 2). While this might appear as a purely theoretical difference, it has numerous implications. For instance, an economy that exists within the natural environment is inevitably constrained by the laws that govern nature, such as the laws of physics (Perrings 1995, 60-64). These external constraints imposed on the economy question many economic models, such as models of growth which, traditionally, focus on measuring the gross domestic product (GDP). Economic growth is finite when it depends on the laws of physics, and has to take into consideration, finite natural resources such as crude oil, minerals, or precious metals. In a traditional model, GDP could grow indefinitely if consumption increases. In an ecological model, there is a physical end to consumption as long as it relies on finite resources.

Figure 1: The Mainstream Economic Approach Figure 2: Ecological Economic Approach (Boulding, 1966)

- Environmental vs Ecological Economics

Ecological economics is easily confused with environmental economics. Environmental and ecological economics are approaching the environments from the two different frameworks illustrated in Figures 1 and 2. Environmental economics uses a version of the mainstream economic framework. It focuses on the use and allocation of resources between the economy and the environment, thereby acknowledging the value of the environment to humanity (Managi et al. 2017). However, one should note that this approach, while granting nature an inherent value, still treats the economy and the environment as two distinct nodes of the network, connected through various interactions. This does not necessarily acknowledge the limitations that the natural environment imposes on the economy as a constructed system of rules and transactions within the natural world.

The inherent value provided by nature is referred to as natural capital (Helm 2013, 16-19). Mainstream economics sees the price to be reflective of a product’s value. This logic, however, also suggests that zero price is equal to zero value. In other words, something that doesn’t have a price, such as forests or landscapes that are freely available to be accessed by anyone, also doesn’t have a value that needs to be considered in an economic calculation. One could argue that nature can be considered a public good. The shortcoming, however, is that a destruction of nature can’t be attributed to a single institutional body that fails to provide this public good as in the case of safety or healthcare. Ecological economics is countering this notion by considering natural capital as opposed to nature as a public good.

Another key distinction between mainstream and ecological economics is the allocation of resources as an end to all economic activity (Daly et al. 2004). In most economic considerations, the efficient allocation of resources is an end in itself. Markets are seen as the mechanism to achieve efficient resource allocation. Ecological economics, on the contrary, rejects efficiency as the single end to economic activity and sees markets as one of many mechanisms for allocating resources. While allocation is also important, other factors are considered, such as welfare to human communities and the environment.

However, even within ecological economics, different streams exist. While all of them challenge the mainstream economic approach, some of them do so more radically than others. One such stream is degrowth theory (Demaria et al. 2016, 390-400). Degrowth theory “implies perceiving ecosystems as having value in themselves, and not only as providers of useful environmental resources or services (Ibid.).” Using resources to produce consumer goods to sell on the market is seen as opposing the protection of nature’s inherent value. To reduce human impact and preserve ecosystems, degrowth suggests cutting back on production and sales, essentially inducing the economic recession mainstream economics seeks to avoid. An economic recession is typically measured in terms of a country’s GDP. By definition of a GDP being the total value produced within a country’s border in a given time period (Segal 2003), this measurement also suggests that value is considered in monetary terms. Ecological economics advocates for a shift in the mindset surrounding the monetary understanding of value. Thus, the preservation of natural capital should be included in any value calculation. This justifies the choice to decrease production and value brought to the market, leaving natural resources untouched instead. The incompatibility of degrowth with today’s international market economy will be examined below.

- Internalizing Externalities: Carbon Licenses and Carbon Taxes

Within mainstream economics, a common response to environmental concerns is the internalization of externalities. For example, carbon licenses are introduced to internalize the cost of and limit CO2 emissions. Under an ecological framework, there are several shortcomings to this approach. Firstly, ecological economics would not see environmental damage as an externality, to begin with. The environment does not take the role of an ‘unrelated third party’ (“Externality” 2013) that experiences damage but is seen as a key stakeholder to be considered. Secondly, the determination of the ‘price’ of carbon is not reflective of the damage done by CO2 emissions. Even if all revenue from carbon licenses was re-invested into environmental conservation efforts, they would still fail to fully internalize the damage done by CO2 emissions, mostly due to the market price of carbon being too low (Dove 2018).

Another approach is carbon taxes. While carbon taxes might be effective in incentivizing individuals and firms to reduce their CO2 emissions, they also fail to compensate for the damage done by CO2 emissions. However, they are worth considering as a policy on a local or national level. As a simple example, if a carbon tax was added to every litre of fuel, using one’s car becomes more costly, and people would be incentivized to find alternatives. Carbon taxes are therefore a cost-effective way to reduce future carbon emissions, however, they are not aimed at leveraging the damage done by carbon emissions.

- The Challenges: Can Ecological Economics become a new status quo?

Many assumptions behind ecological economics contradict those of mainstream economics. The logic behind ecological economics sounds ideologically compelling: It factors in human and non-human well being alike, so why shouldn’t ecological thought be a more dominant force in economics?

To address this question, it is important to recognize the incompatibility of streams like degrowth theory with the international market economy today. From an ecological perspective, loosely- or unregulated markets are not creating the most efficient outcome as they don’t always address who owns certain assets or who pays for pollution in the production process. They also fail to account for the factor of finite resources. For example, if the market price of crude oil is US$ 70/ barrel, then this price is reflective of the supply and demand for crude oil at this time. Supply and demand, in turn, encapsulate factors such as the cost of extraction, transportation, or tariffs. However, the price fails to reflect the fact of oil being a finite resource. While the price accounts for current supply and demand, it doesn’t account for the fact that consuming oil is bringing global oil reserves one step closer to depletion. Ecological economics would require such a measure and hence a fundamental change in the way markets operate.

Another issue that illustrates that ecological economics contradicts many ideas in mainstream economics is that environmental protection faces the challenge of temporal discounting. Temporal discounting, simply put, refers to the phenomenon of ascribing less value to outcomes in the far future than to outcomes in the present (Behavioral Economics 2018). In other words, we tend to give less weight to a reward lying 10 years into the future than we do to a reward that occurs tomorrow. Environmental processes span over long time-periods which pose challenges to policy makers and economists. Temporal discounting in ecology is in fact intergenerational. For instance, the preservation of forests may not necessarily affect current generations directly, but will certainly impact generations to come by preserving earth’s CO2 absorption capacity and keeping vital ecosystems intact.

Finally, it is important to identify that the exploitation of resources currently stands in a non-linear relationship to internalization of environmental costs. An example can be global discrepancies between deforestation and reforestation. In a sustainably managed forest, an initial loss of tree coverage should result in a gain in coverage a few years later, once young trees grow large enough to appear as a gain in forest cover (Global Forest Watch, 2018). According to Global Forest Watch (2018), the opposite is the case when it comes to reforestation. In fact, reforestation efforts lack behind deforestation, leading to the permanent loss of tree cover (Ibid.). This indicates that reforestation efforts are not currently able to compensate for deforestation as total tree coverage decreases. This non-linear relationship makes it hard to internalize the real environmental cost resulting from economic activity.

- What Does a Forest Cost? Carbon Licenses as a Means to Stop Indonesia’s Deforestation

Ecological economics, as seen in Figure 2, is based on the environment being the all-encompassing framework of economic and other activity. Thus, to sustain any human activity on earth, the environment has to be kept intact first. In the case of deforestation, this poses several challenges, most prominently the question “what does a forest cost?”. To determine the real value of choosing to keep a forest rather than logging it, ecological economics takes into account multiple factors (Warren-Thomas et al. 2018):

- The opportunity cost (forgone economic return) of deforestation. Like in mainstream economics, one needs to estimate the revenue from logging, subtracting the monetary cost of logging.

- The cost of implementation to conserve forest. This could include patrols; free, prior and informed consent (FPIC) of indigenous communities living in the area, or institutional and administrative costs (Luttrell 2018, 291-310). Many implementation costs are likely to be carried out by the central government of a country. In mainstream economics, a problem arises when the cost of implementation exceeds the opportunity cost. In other words, when the cost of implementation is larger than the revenue that could have been generated from logging the forest. If keeping the forest is not considered inherently valuable, this scenario makes forest conservation the least economical decision for a government. (Fisher et al., 2011)

- The benefit of keeping the forest. This cost is the hardest to estimate as this would require a cost to be put to benefits such as carbon absorption, providing a habitat for local species, or keeping a greater ecosystem intact.

An example of estimating the cost and benefits of keeping a forest can be seen by examining select details surrounding rainforests in Indonesia. The expansion of rubber plantations in Indonesia is the main driver for deforestation and the resulting loss of biodiversity. To stop deforestation, the revenue from rubber plantations will have to at least be matched. In other words, the opportunity cost would have to be alleviated by giving rubber producers at least as much as they would earn from cutting down rubber trees (Warren-Thomas et al. 2018). In their paper, Warren-Thomas et al. (2018) found that different types of opportunity costs arise in Indonesia’s rainforests and thus depend on the institutionally regulated selection criteria for logging. The two most prominent types of opportunity costs are the revenue from timber and the revenue from rubber where carbon is accounting for about 75% of the opportunity cost of conserving a dense forest (Warren-Thomas et al. 2018). Per hectare of dense forest, deforestation in Indonesia comes at the cost of an average of 194 tons of carbon that the forest could have absorbed. (Ibid.)

Using carbon financing as a common way to internalize externalities under a mainstream economic framework, deforestation could thus be stopped at the cost of high enough carbon prices + transaction costs + implementation costs. Revenues could go to the development of green technology, or conservation and reforestation projects that compensate for the carbon absorption capacity lost through deforestation. However, this calculation works only under the assumption that the market price of carbon is high enough to offset the incurring cost. This ‘real’ carbon cost can be seen as an attempt to estimate the benefit, in carbon terms, of keeping the forest (as discussed in factor “c” above). Warren-Thomas et al. (2018) yet concluded that the current market price of carbon is insufficient to offset the cost of deforestation. While the required market price for carbon should oscillate somewhere between $30 - $51 per ton of carbon, the current price oscillates between $5-$20 per ton (Carbon Brief 2017).

This price often neglects the, more policy-relevant, social cost of carbon. The social cost of carbon refers to “economic harm […] expressed as the dollar value of the total damages from emitting one ton of carbon dioxide into the atmosphere” (Environmental Defense Fund 2017), including compromised health around the world, increasing food prices, or the destruction of property.

From an ecological economic perspective, carbon financing is an insufficient way to address commodity-driven deforestation in Indonesia. Carbon prices should be increased to at least offset the damage done with regards to carbon emissions and absorption. However, even a carbon price of $30- $51 doesn’t address all aspects of deforestation that ecological economics would consider such as the loss of biodiversity, or the long-term effects of bringing an existing ecosystem out of balance. It also fails to account for changes in soil brought about by monocultures for rubber plantations, or the social cost occurring from deforestation, for example, the destruction of property of Indonesia’s indigenous communities (IUCN 2018).

- Conclusion: Current Trends and Alternatives

Carbon Financing is one solution that is currently being implemented to offset some of the damage done by deforestation. However, carbon financing is not excluded from the phenomenon of non-linearity outlined in section 3. The market price of carbon is currently too low to make carbon financing an adequate solution (Dove 2018), yet, it can be seen as one step in decreasing opportunity cost and incentivizing communities and governments to preserve forests. Other trends and alternatives include mechanisms like corporate zero-deforestation pledges in which corporation pledge to “eliminate deforestation from their supply chain” (Riley 2017). Also, the general focus on local, community-based solutions is frequently discussed, such as protecting and supporting smallholder agriculture and restricting agriculture on a larger corporate scale. Most of these trends share the common element of tending to deviate from what is the most economically efficient way to produce commodities in a mainstream economic framework. This is because mainstream economics disregards many of the environmental values that are a focus of ecological economics. From an ecological point of view, smallholder agriculture or costly-alternatives to commodities like rubber and palm oil seem much more attractive and worthwhile. While it may decrease the global supply of a commodity and increase prices, it preserves the environment and therefore takes into account the quality of life for current as well as future generations. Approaches like replacing large corporations and their environmental impact with smaller subsistence-based solutions are especially in line with degrowth theory as a more radical stream within ecological economics. All in all, Ecological economics poses significant challenges to mainstream economics that make it difficult to be adopted as a new status-quo in economic thought. Yet, it can be utilized as a lens to re-think the role nature plays in economic consideration and identify necessary steps to avoid traps like generational discounting or the illusion that economic growth can be sustained independently from the natural world.

References:

For more recent statistics on deforsestation, see https://www.treetriage.com/tree-removal/deforestation/

Boulding, Kenneth E. “The Economics of the Coming Spaceship Earth.” (1966).

Daly, Herman E, and Joshua C Farley. 2004. Ecological Economics: Principles and Applications. Washington: Island Press.

"Deforestation: Solved Via Carbon Markets?". 2018. Environmental Defense Fund. Accessed November 20, 2018. https://www.edf.org/climate/deforestation-solved-carbon-markets.

Demaria F, Schneider F, Sekulova F, Martinex-Alier J. "What Is Degrowth?: From an Activist Slogan to a Social Movement." In The Environment in Anthropology (Second Edition): A Reader in Ecology, Culture, and Sustainable Living, edited by Haenn Nora, Wilk Richard R., and Harnish Allison, 390-400. NYU Press, 2016.

Dove, M. (2018). 'Rubber versus forest on contested Asian land'. Nature Plants, 4(6), 321-322.

"Externality". 2018. Investopedia. Accessed December 13, 2018. https://www.investopedia.com/terms/e/externality.asp.

Fisher B, Lewis S, Burgess N, Malimbwi R, Munishi P, Swetnam R, Turner R, Willcock S, and Balmford A. “Implementation and opportunity costs of reducing deforestation and forest degradation in Tanzania” Nature Climate Change 1 (2011): 161–164.

“Global Forest Watch”. 2018. Global Forest Watch.Com. Accessed November 21, 2018. http://www.globalforestwatch.org/

Helm, Dieter. "NATURAL CAPITAL." RSA Journal 159, no. 5553 (2013): 16-19.

"Indonesia’s Last Frontier: Indigenous Peoples’ Rights Key to Forest Preservation". 2018. IUCN. Accessed November 24, 2018. https://www.iucn.org/news/forests/201802/indonesia%E2%80%99s-last-frontier-indigenous-peoples%E2%80%99-rights-key-forest-preservation.

Luttrell C, Sills E, Evinke M.F, Aryani R, and Ekaputri A.D. 2018. “Beyond Opportunity Costs: Who Bears the Implementation Costs of Reducing Emissions from Deforestation and Degradation?” Mitigation and Adaptation Strategies for Global Change 23 (2): 291–310. doi:10.1007/s11027-016-9736-6.

Managi, Shunsuke, and Kuriyama Kōichi. 2017. Environmental Economics. Routledge Textbooks in Environmental and Agricultural Economics, 17. London: Routledge, Taylor & Francis Group.

Philip Fearnside (2000). "Global warming and tropical land-use change: Greenhouse gas emissions from biomass burning, decomposition and soils in forest conversion, shifting cultivation and secondary vegetation". Climatic Change. 46: 115–158. doi:10.1023/a:1005569915357

Perrings, Charles. "Ecology, Economics and Ecological Economics." Ambio 24, no. 1 (1995): 60-64

"Q&A: Will the Reformed EU Emissions Trading System Raise Carbon Prices? | Carbon Brief". 2017. Carbon Brief. Accessed November 24, 2018. https://www.carbonbrief.org/qa-will-reformed-eu-emissions-trading-system-raise-carbon-prices.

Riley, T. (2017). Companies' ‘zero deforestation’ pledges: everything you need to know. the Guardian. Retrieved 16 October 2018, from https://www.theguardian.com/sustainable-business/2017/sep/29/companies-zero-deforestation-pledges-agriculture-palm-oil-environment

Segal, Troy. 2003. "Gross Domestic Product - GDP". Investopedia. Accessed November 3, 2018. https://www.investopedia.com/terms/g/gd

"The True Cost of Carbon Pollution". 2017. Environmental Defense Fund. Accessed November 24, 2018. https://www.edf.org/true-cost-carbon-pollution.

"Time (Temporal) Discounting | Behavioraleconomics.Com | The BE Hub". 2018. Behavioraleconomics.Com | The BE Hub. Accessed November 4, 2018. https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/time-temporal-discounting/.

Warren-Thomas EM, Edwards DP, Bebber DP, Chang P, Diment AN, Evans TD, Lambrick FH, et al. 2018. “Protecting Tropical Forests from the Rapid Expansion of Rubber Using Carbon Payments.” Nature Communications 9 (1): 911–11. doi:10.1038/s41467-018-03287-9.

“2.1 Interdependence”. 2018. Soas.Ac.Uk. Accessed October 28, 2018. https://www.soas.ac.uk/cedep-demos/000_P505_NRE_K3736-Demo/unit1/page_13.htm.