Financial Theory

Description

This course attempts to explain the role and the importance of the financial system in the global economy. Rather than separating off the financial world from the rest of the economy, financial equilibrium is studied as an extension of economic equilibrium. The course also gives a picture of the kind of thinking and analysis done by hedge funds.

Texts

- Bodie, Zvi, and Robert C. Merton. Finance, Upper Saddle River, New Jersey: Prentice Hall, 2000.

- Chance, Don M. An Introduction to Derivatives, 3rd edition, Fort Worth, Texas: The Dryden Press, Harcourt Brace College Publishers, 1995.

- DeGroot, Morris H. Probability and Statistics, Reading, Massachusetts: Addison-Wesley Publishing Co., 1975.

- Elton, Edwin J. and Martin J. Gruber. Modern Portfolio Theory and Investment Analysis, 5th edition, New York: John Wiley & Sons, Inc., 1995.

- Fabozzi, Frank. Handbook of Mortgage Backed Securities, 6th edition, New York: McGraw-Hill, 2001.

- Fabozzi, Frank J. Handbook of Fixed Income Securities, 6th edition, New York: McGraw-Hill, 2000.

- Hull, John C. Options, Futures, and Other Derivatives, 5th edition, Upper Saddle River, New Jersey: Prentice Hall, 2002.

- Jarrow, Robert and Stuart Turnbull. Derivative Securities, 2nd edition, Cincinatti, Ohio: South-Western College Publishing, 2000.

- Luenberger, David G. Investment Science, New York: Oxford University Press, 1998.

- Malkiel, Burton. A Random Walk Down Wall Street, New York: W.W. Norton, 1999.

- Pliska, Stanley R. Introduction to Mathematical Finance. Discrete Time Models, Malden, Massachusetts: Blackwell Publishers, 1997.

- Ross, Stephen, Randolph Westerfield, and Jeffrey Jaffe. Corporate Finance, New York: Irwin, McGraw Hill, 1999.

- Sharpe, William F., Gordon J. Alexander, and Jeffery V. Bailey. Investments, 6th edition, Upper Saddle River, NJ: Prentice Hall, 1999.

- Swensen, David F. Pioneering Portfolio Management. An Unconventional Approach to Institutional Investment, New York: The Free Press, 2000.

- Taggart, Jr, Robert A. Quantitative Analysis for Investment Management, Upper Saddle River, New Jersey: Prentice Hall, 1996.

- Tobin, James with Stephen Golub. Money, Credit, and Capital, Boston: Irwin-McGraw Hill, 1998.

Comment from our editors:

This Yale College course was recorded in Fall 2009. It's a great resource for everyone interested in financial economics theories, the ones that use mathematical logic along with economics thinking.

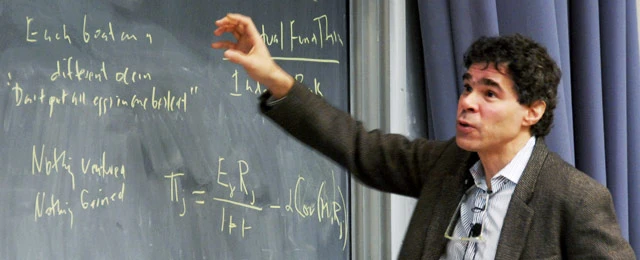

Dr. John Geanakoplos explains the reasons behind incorporating this course in Yale undergrad syllabus in addition to the main differences between financial theory and standard theory, through the introduction of multiple concepts that ease the depth understanding of the financial markets.

For the purpose of responding to the following question: Can we make economics more mathematical? The course has been divided into 26 sessions.