On the Rate of Profit

Rethinking Economics, 2020

Pluralist Showcase

In the pluralist showcase series by Rethinking Economics, Cahal Moran explores non-mainstream ideas in economics and how they are useful for explaining, understanding and predicting things in economics.

On the Rate of Profit

By Cahal Moran

Depending on who you ask, we at Rethinking Economics are either ragingly Marxist or not Marxist enough. For the purposes of this series, though, the question is which parts of Marxism contain coherent economic theories which we can test empirically. My knowledge of Marxism is relatively limited, but to my mind the theory which most fits the bill is the Tendency of the Rate of Profit to Fall (TRPF), which was central to Marx’s ideas about how capitalism would lead to recurrent crises, creating social dislocation and the potential for revolution. And one does not have to buy Marx’s politics to admit that the facts are on his side here.

First, we need to know the underlying theory (warning for some jargon, which I will try to keep to a minimum), which brings us to the labour theory of value. For Marx, labour was the source of ‘value’ in an economy, and so unlike capital (equipment, buildings, raw materials) it could produce value in excess of what is was paid. Workers would work 8 hours a day but their wages would only be worth 3 hours of their own labour, while the capitalist effectively pocketed the remaining 5 by selling commodities produced by the workers on the market. Capital therefore relied on the exploitation of labour to make money - not in the sense that workers were treated badly (though they might be), but a type of exploitation where workers are not paid as much as they produce, which Marxists see as inherent to capitalism.

This also leads to one of Marx’s oft-referenced ‘contradictions of capitalism’, one which is the basis for the TRPF. Even though capitalists rely on labour for profit, over time they tend to substitute capital for labour due to technological change, increasing the ratio of capital to labour - a ratio known as the Organic Composition of Capital (OCC). Since capital does not produce surplus but labour does, a rise in the OCC spells a decline in the surplus extracted and therefore the profit made per unit of cost – the Rate of Profit (RoP). Countering this is that capitalists will try to increase the rate of exploitation by increasing labour hours, intensity, reducing pay and benefits, and the like – all of which will counteract the tendency, but not prevent it in the long run.

One immediate puzzle is why capitalists invest in capital when it’s going to reduce their profits. There are two main answers. Firstly, even if the RoP falls total profits can rise. If a firm is investing £100 and making £140, they have a 40% rate of profit. If they then double their investment but only make a 30% rate of profit, they will now make £60 in profit. Total profits rising over time therefore does not (as is often thought) falsify Marx’s theory. Despite this, it is reasonable to suggest capitalists care about the rate of profit too – after all, businesses pursue returns as well as overall profit – so why do they bother with labour-saving technology anyway?

The answer is that at the level of the individual firm, investment can increase productivity and quality and allow capitalists to undercut the competition. However, over time the spread of new technology and investment by other firms drives the price of their product down so profits fall. The initial investment allows – indeed, incentivises – capitalists to get ahead of the competition as they can still charge the market price, but over time across these gains will be competed away and the TRPF will assert itself. This is why the RoP is best measured at the aggregate level and over the long-term, rather than in individual firms in the short-term.

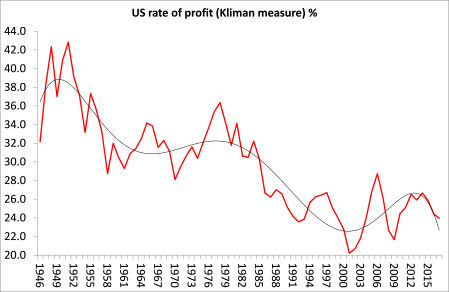

Enough theory. The crucial question is whether we actually observe the TRPF in reality. If we do, it is worth noting even if you think the preceding is a load of nonsense. Fortunately numerous Marxists have attempted to measure the RoP in recent years. Michael Roberts in particular has a website at which he blogs extensively, periodically updating his estimates for rates of profit. As usual the USA has arguably the highest quality data, though it is only available since 1945. And it illustrates a fluctuating but unmistakably declining RoP (try to ignore the various different measures and acronyms on the graphs – they all show roughly the same picture, and the reasons for the different definitions are rabbit holes which are beyond the scope of this blog post):

According to Marxist theory, the declining RoP is what leads to recurrent crises under capitalism, since it reduces incentives to invest and even spurs capitalists to seek profit through other means, with political implications. Roberts usefully separates the graph into four periods: the post-WW2 ‘Golden Age’ of capitalism when it was high but declining; the crisis of the 70s; early neoliberalism where it recovered; and the contemporary period where it is stagnant or declining.

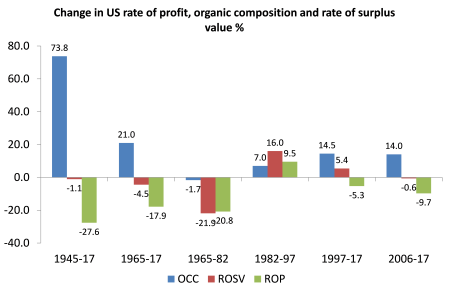

The theoretical dynamics outlined above shed some light on this historical process: the Great Depression and WW2 destroyed a lot of capital value (literally in the case of the latter), thus reducing the ratio of capital to labour – the OCC - and resulting in a high rate of profit post-WW2. Nevertheless, as per Marx the process of substituting capital for labour increased the OCC over the next couple of decades and created a profitability crisis during the 1970s. If you unpack the various categories you can see what happened more clearly:

During the labour crises of the 60s & 70s the Rate of Surplus Value (ROSV) - i.e. the surplus extracted from labour - actually declined due to labour militancy, resulting in stagflation. Eventually repression of labour increased the ROSV and temporarily restored profitability in the 80s & 90s. However, since then the OCC has risen again and the RoP has continued its inevitable decline. Andrew Kliman has suggested that financialisation and the subsequent 2008 financial crisis were in large part a response to this, as capital moved into finance due to an inability to make profit in more ‘traditional’ capitalist investments.

Roberts and others have illustrated that one can tell a similar story for the UK:

…and even for the world rate of profit (caveat emptor for measurement issues):

Thus, Marx’s theory of the falling rate of profit is not only empirically borne out, but the theory he proposed seems to describe accurately how that happens. Furthermore, the whole process is useful for understanding the history of contemporary capitalism.

There are of course countless criticisms of Marx out there. The dense layer of jargon – with multiple terms for the same thing, and terms which mean one thing outside Marxism meaning something different within it – make it confusing and difficult to teach, which in my opinion is a substantial issue for spreading ideas. As alluded to earlier, there are a number of theoretical rabbit-holes and qualifiers which have sparked endless debates: for example, Marx’s distinction between ‘productive’ and ‘unproductive’ labour, since only the former matters for the TRPF but it is difficult to find a clear ex ante way to distinguish the two (services are a huge focal point of controversy here). This can lead to the kind of circuitous debates that in my opinion plague Marxism and, as before, put people off.

But as I mentioned above, the falling rate of profit is itself an interesting empirical phenomenon, and Marx’s theory does a good job of shedding some light on the mechanisms that drive it beyond the aggregate trend. So too is it a helpful device for framing the history of modern capitalism, and strangely in a way that – to my mind, at least – could be considered complementary to the standard neoclassical story. Such is the value of pluralism!

There is still so much to discover!

In the Discover section we have collected hundreds of videos, texts and podcasts on economic topics. You can also suggest material yourself!