Killik Explains: Fixed Income Basics - the yield curve

Killik & Co., 2015

Description

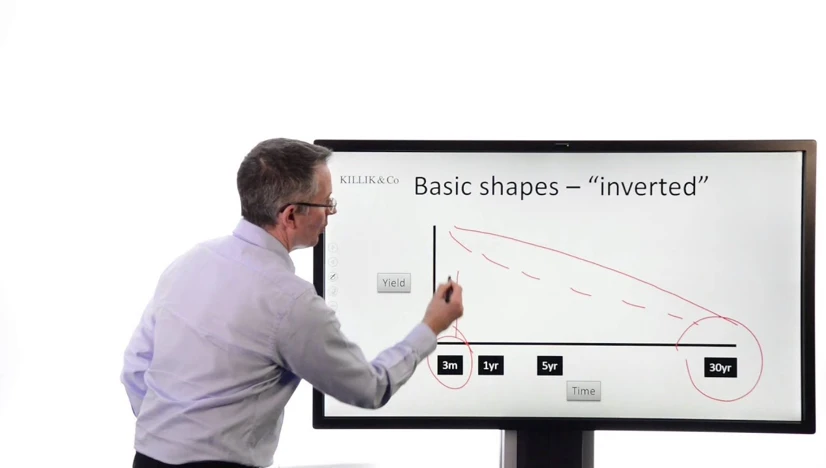

Yield curves effectively are the summary of the bond market's assessment of a country's macroeconomic prospects: Showing the yields of various government bonds across tenors (the period of time until a bond's maturity), it demonstrates what economic development debt investors expect for the near as well as the distant future.

Comment from our editors:

Quite apart from different schools of economic thought, yield curves as the summary view of debt investors about the macroeconomic prospects in the near as well as the long term are a most relevant statistic of financial markets, because it is sovereign debt where investors flee to when the economy begins to sputter. Thus, it is a powerful tool to assess investors expectations, something very hard to ascertain otherwise.

Go to: Killik Explains: Fixed Income Basics - the yield curve