Effective sanctions against oligarchs and the role of a European Asset Registry

EU Tax Observatory / World Inequality lab, 2022

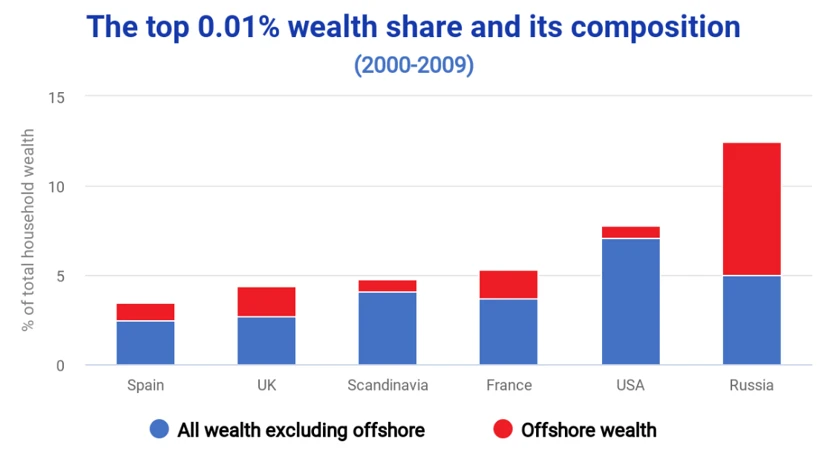

This note, by Theresa Neef, Panayiotis Nicolaides, Lucas Chancel, Thomas Piketty, and Gabriel Zucman, provides data on wealth inequality in Russia and advocates for a European Asset Registry. Russia exhibits the highest wealth inequality in Europe. Further, Russia’s wealthiest nationals conceal a large share of their wealth through tax havens. The current architecture of the global financial system impedes comprehensive knowledge on beneficial ownership across asset types and jurisdictions. Under the roof of a European Asset Registry, the already existing but currently dispersed information could be gathered. This would change the state of play, resulting in better-targeted sanctions and effective tools to curb money laundering, corruption and tax evasion. The European Union could have a pioneering role in taking the next step towards more financial transparency.

Comment from our editors:

The paper is a very useful contribution to the ongoing debate about economic sanctions, because it adresses the problematic that sanction regimes often predominantly affect people on the lower end of a country's income and wealth distribution, while economic elites - especially the most wealthy - can evade sanctions despite their powerful position in the respective society. A second key contribution of the paper is to highlight the fact that rather than being a specific feature of the Russian economy, these possibilities result from the general set-up of the global financial system, which is structured in a way that benefits wealth owners and leaves plentiful opportunities for hiding wealth. It is thus only consequent that the authors propose policies aimed at closing (at least some of) those gaps through the creation of a European Asset Registry.

Go to: Effective sanctions against oligarchs and the role of a European Asset Registry