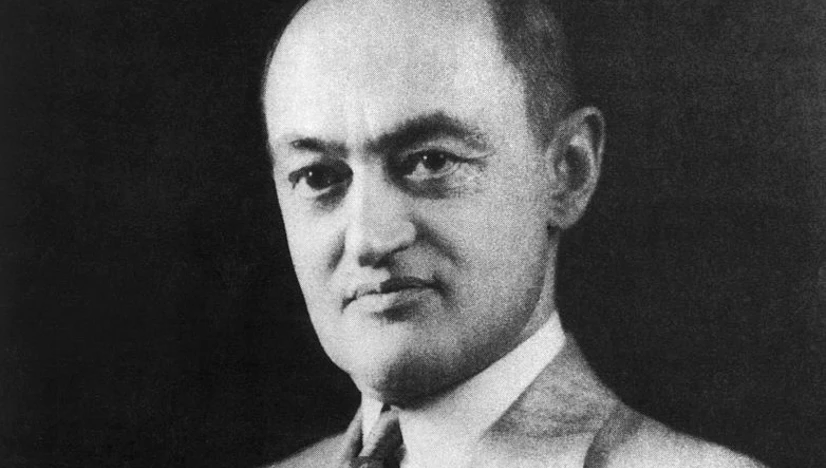

Discovering the 'true' Schumpeter: New insights on the finance and growth nexus

voxEU, 2022

This article demonstrates Schumpeter's propagated approach to monetary analysis in macroeconomics so as to provide for a better understanding of the relation between finance and growth.

Comment from our editors:

While mainstream literature usually depicts banks as intermediaries that depend on deposited savings in order for lending and investment to occur, Schumpeter rightly contests the corresponding loanable funds theory (originating in the so-called currency school) and substitutes it for a more realistic framework for understanding the process of liquidity creation and economic activity, much like in the tradition of the banking school. The authors provide an excellent critique of prevailing macroeconomic theory and contribute to the closing of the empirical gap still comprising much of the economic thought today.

Go to: Discovering the 'true' Schumpeter: New insights on the finance and growth nexus