Climate Economics and the DICE Model

Exploring Economics, 2018

We collect material summarizing the insights and achievements of the works awarded with Sveriges Riksbank Prize in Economic Sciences. Besides giving you an overview of the laureates we want to provide you with critical & plural perspectives on the respective theories and methodologies.

The 2018 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel was awarded to William D. Nordhaus and Paul Romer. This text summarizes the content of Nordhaus' model and extends by some critical perspectives on this topic.

Overview

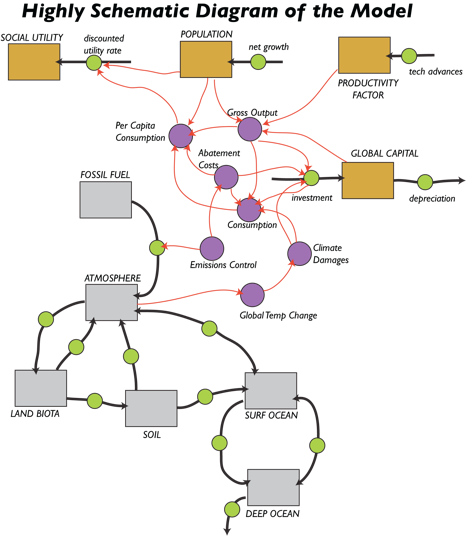

Nordhaus was awarded the Nobel prize “for integrating climate change into long-run macroeconomic analysis”. The video above is a brief summary of his work. Nordhaus was among the first economists who wanted to integrate insights from natural and climate science into long term macroeconomic models in the 1970s. In order to do so, he created the DICE model (Dynamic Integrated Climate Economy model) which is part of the Integrated Assessment Models (IAM) using a Cost-Benefit-Analysis (CBA). The starting points of his analysis were the uncertainties of climate change and the market failure CO2 emissions represent. In the following graph, you can see a schematic DICE model.

Nordhaus DICE Model uses a common neoclassical Ramsey growth model in which he integrated a damage function, an abatement function and equations to relate GDP growth to the increase in CO2 levels as well as the impact of that increased CO2 on the average global temperature.

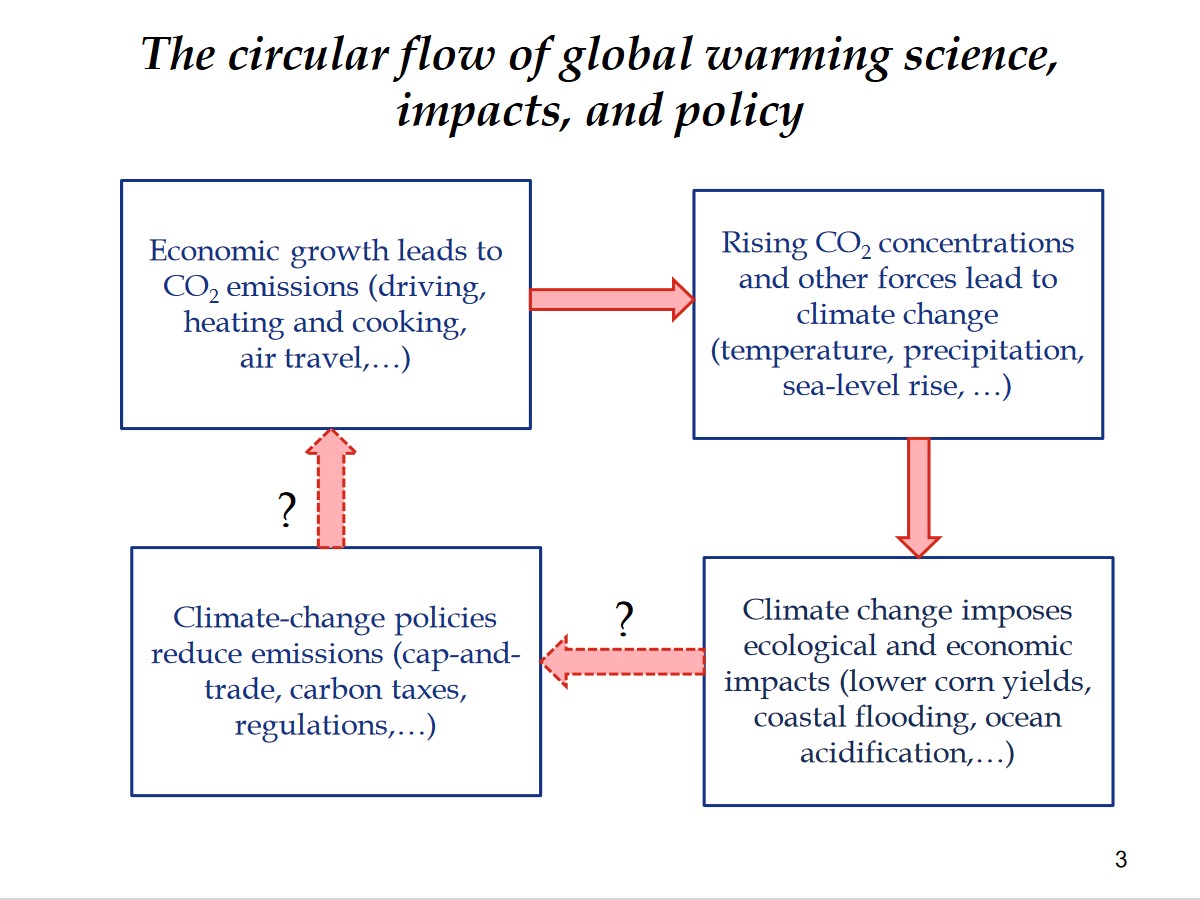

Source: Slide 3 of Nordhaus' Nobel Lecture in Economic Sciences Stockholm UniversityDecember 8, 2018 (link)

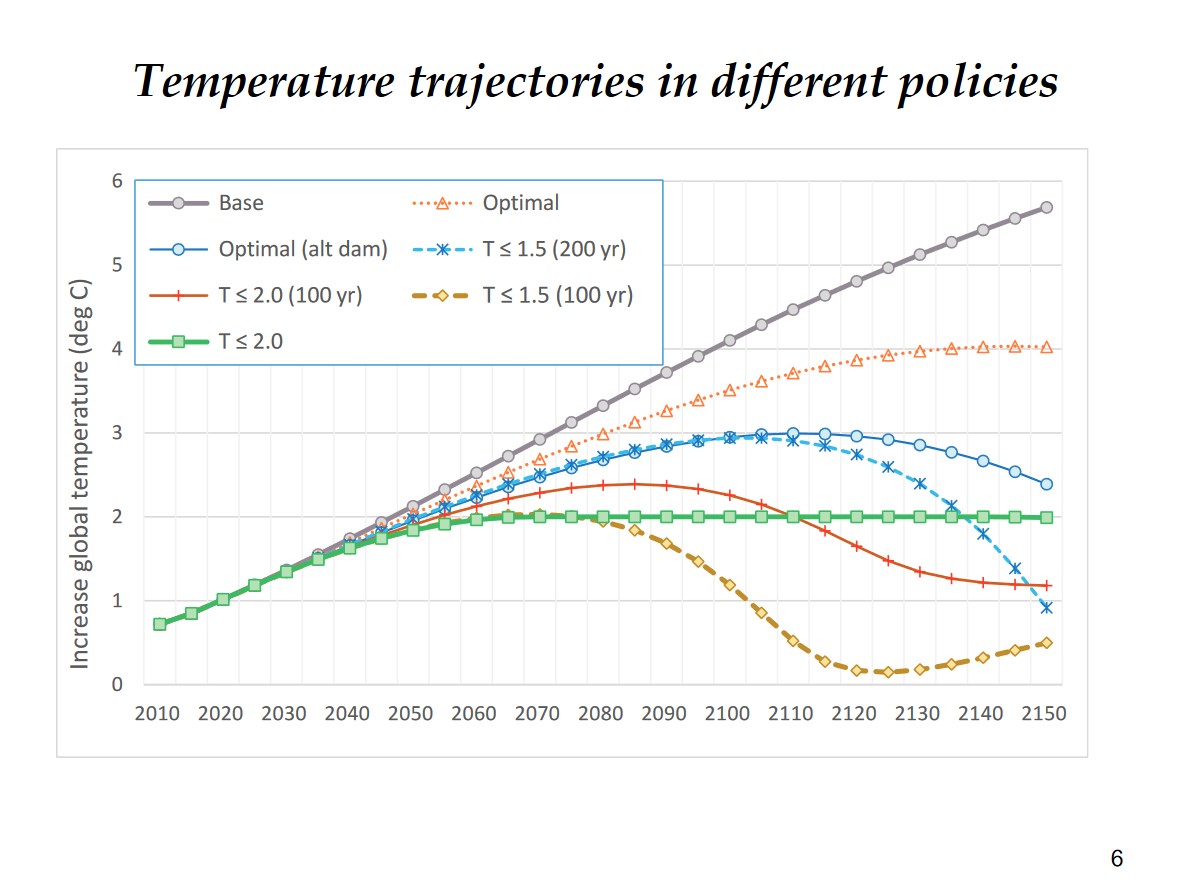

Applying this model, Nordhaus derived various warming pathways. As you can see in the Nobel Prize lecture, the result of the DICE model draws different warming pathways. The cost-benefit optimum would be a global temperature rise of 4-degree Celsius by 2150. 4-degree warming will cause damages of 15$ trillion and the abatement costs related to this rise in temperature are 3$ trillion. Nordhaus was one of the first who advocated for a prize on carbon emissions (Pigouvian tax) to internalise the external effects of climate change.

Source: Slide 6 of Nordhaus' Nobel Lecture in Economic Sciences Stockholm University, December 8, 2018 (here)

Find some more perspectives here

-

William Nordhaus. Projections and Uncertainties about Climate Change in an Era of Minimal Climate Policies

-

In this recent paper from 2018, Prof Simon Dietz and his co-authors compare the costs and benefits of striving towards a 2 degree or 1.5-degree goal. He uses a simple CBA and no DICE model in “The economics of 1.5 degree”:

-

Geoffrey Heal. “A celebration of environmental and resource economics”: Gives a very positive overview of the strengths contemporary environmental Economics poses to deal with climate change.

Some critical perspectives

Weitzman - Nordhaus debate:

-

In 2009 Martin Weitzmann criticised Nordhaus use of a small tail climate risk. Instead of using a thin tailed distribution, he suggests using fat tails. This results in his Dismal Theorem which says that society can face indefinable high losses (in Expected Utility) from so-called “high-impact, low-probability catastrophes”. In numbers: The probability of a temperature rise of 10-degree Celsius is 5% and the chance that temperatures will rise by 20-degree Celsius is 1% given a doubled emission of GHG compared with pre-industrial level (so-called climate sensitivity). He incorporates the feedback mechanisms like degraded permafrost soils, wetlands, and clathrates. The problem is in his words: “fat tails conjoined with fat tails beget yet-fatter tails. His basic argument is, holding these probabilities in mind, that we have to take huge actions to avoid such a climate catastrophe. Therefore he can be seen as an advocate for the “precautionary principle”. Further on he thinks that a CBA is not suitable to deal with these extreme probabilities. Dismal Theorem: Weitzman, M. L. (2009) On Modeling and Interpreting the Economics of Catastrophic Climate Change. Review of Economics and Statistics 91: 1–19.

-

In response: In a reply to Weitzman's Dismal Theorem, Nordhaus appreciates the contribution in the first step, but discards them in the second. Besides other critiques, Nordhaus main critique is that it is impossible to derive policy advice using the dismal theorem. Due to infinite expected loss, standard economics analyses can not be applied. Nordhaus advice is to wait to get more reliable data. “This means that we can learn, and then act when we learn, and perhaps even do some geoengineering while we learn some more or get our abatement policies or low-carbon technologies in place.” Nordhaus makes clear that for him climate change is to some extent an exogenous problem by comparing it to Alien invasions, asteroids and earthquakes. Nordhaus, W. D. (2011) The Economics of Tail Events with an Application to Climate Change, Review of Environmental Economics and Policy 5: 240257.

More fundamental critiques

-

In this blogpost, Steve Keen criticises the use and structure of Nordhaus damage function which is a key part of the DICE models. The main problem is that Nordhaus assumes that it is quadratic and therefore can not account for sudden shocks or fundamental disruptions. Therefore climate tipping points are explicitly excluded from his analysis.

-

Eugen Pissarskoi criticized the normative foundations of most of the DICE models (in German).

Go to: Climate Economics and the DICE Model