Coping with disasters: Lessons from two centuries of international response

VOX CEPR Policy Portal, 2020

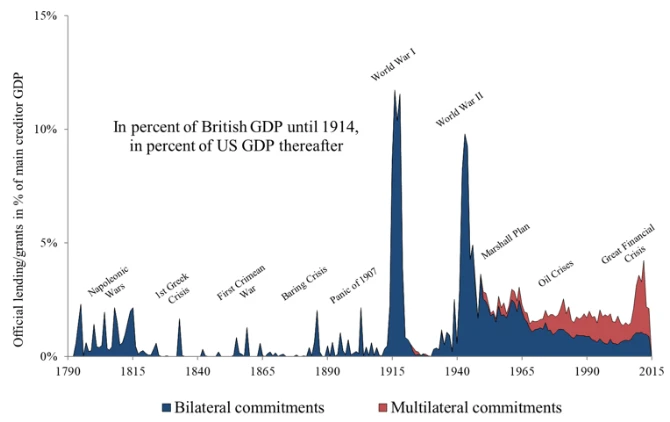

The world is coping with a global disaster, as the new Coronavirus takes a toll on many lost lives and a severe impact on economic activity. To provide a long-run perspective, this column documents the international response to a variety of disasters since 1790. Based on a new comprehensive database on loans extended by governments and central banks, official (sovereign-to-sovereign) international lending is much larger than generally known. Official lending spikes in times of global turmoil, such as wars, financial crises or natural disasters. Indeed, in these periods, official capital flows have repeatedly surpassed total private capital flows in the past two centuries. Wars, in particular, were accompanied by large surges in the volume of official cross-border lending.

Comment from our editors:

This article talks about the government lending during global crisis including wars, epidemics, etc. Over the past two centuries, official creditors have played an important (and occasionally dominant) role in international finance. While some episodes of official international lending and assistance are well known (the Marshall Plan, IMF/EU bailouts during the Global Financial Crisis), the broader trajectory of official lending remains largely obscure.

It is observed in Horn et al. dataset that the official capital flows are highest when private capital flows dry out. (both are negativey correlated). Official international loan and grant flows (government to government, including bilateral and multilateral institutions) includes commitments through grants, loans and guarantees, but excludes official portfolio investments and central bank swap credit. Private capital flows consist of net foreign direct investment and portfolio investment.

The return of official lending: New creditor powers, new safety nets, and central bank swap lines. The global financial safety net (the vehicles for bilateral, regional and multilateral official lending) is large and diverse (Scheubel and Stracca 2016). Currently, resurgence of official cross-border financing via central banks is seen. Since the financial crisis of 2008 the Federal Reserve Bank, the ECB and the Bank of Japan have granted record amounts of ‘swap lines’ via a network of standing credit lines that allow drawing overnight foreign currency loans (Bahaj and Reis 2019).

Go to: Coping with disasters: Lessons from two centuries of international response